Explore Other Resources

Subscribe Today!

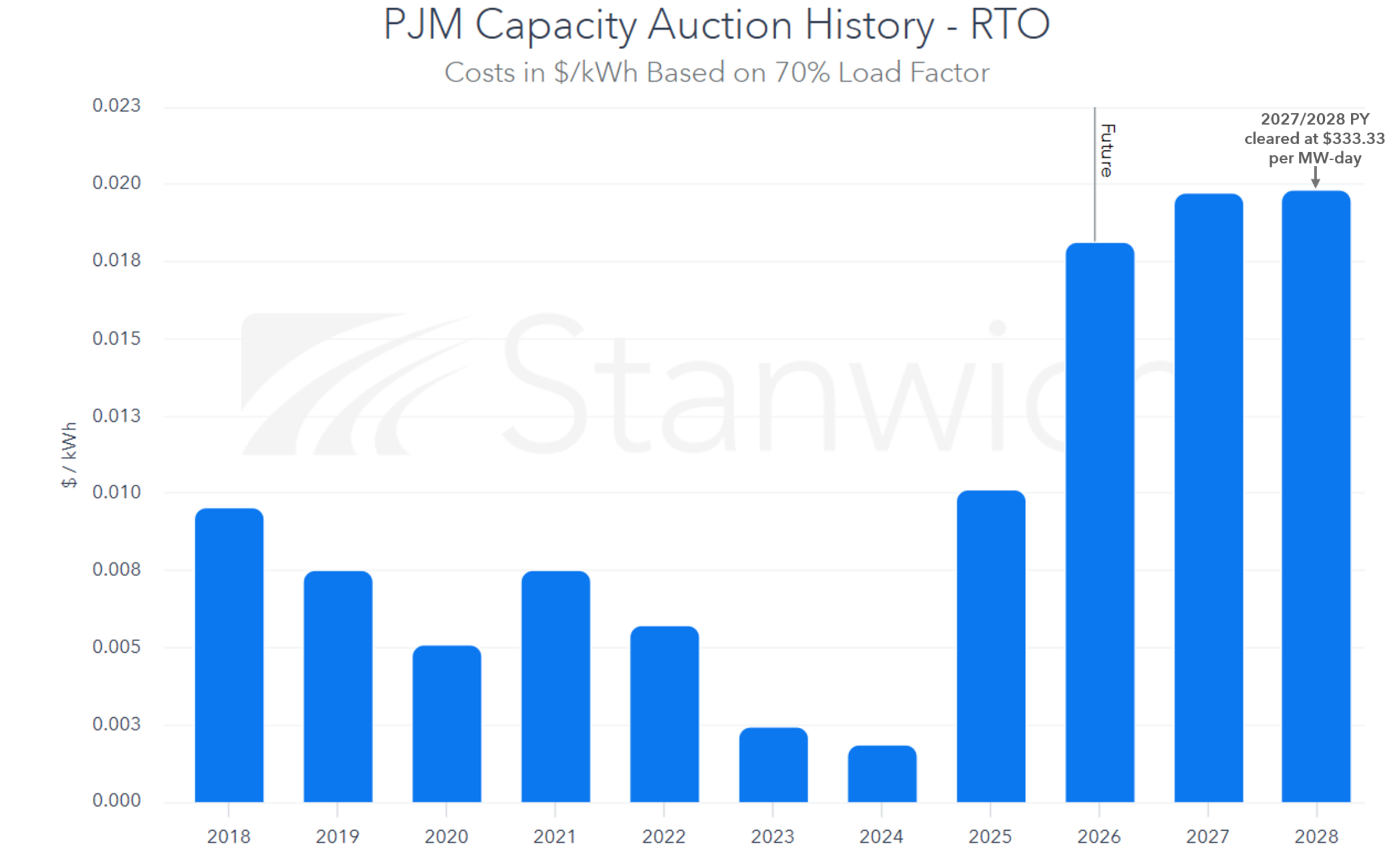

PJM’s 2027/2028 Capacity Auction: Higher Load Forecasts Push Prices to the Cap Again

PJM’s capacity market is how the grid secures future reliability. It is designed to ensure there is enough generation available to meet future peak demand by locking in commitments several years in advance. Those commitments have real price impacts for customers, because capacity charges are a big component in the total cost of electricity for PJM end users.

What happened with the 2027/2028 auction

PJM’s 2027/2028 Base Residual Auction cleared at the RTO-wide price cap of $333.44 per MW-day. All modeled areas cleared at the same price, meaning there were no higher-priced constrained zones that produced adders this year.

This result was slightly higher than the prior auction for the 2026/2027 planning period, which also cleared at the cap, $329.17 per MW-day. The key point for customers is that the price increase was not driven by a sudden change in bidding behavior. It reflects a higher reliability target and higher forecasted need going into the auction.

Why the price was higher than last year

Three planning inputs moved meaningfully upward for 2027/2028, and together they raised the amount of capacity PJM had to procure.

Forecasted load increased: PJM increased its forecasted peak load by more than 5,200 MW, driven largely by additional large loads. When PJM expects higher peak demand, it must procure more capacity.

IRM increased: The Installed Reserve Margin increased from 19.1% to 20.0%. A higher IRM means PJM is targeting a larger reliability buffer above forecasted peak demand, which directly increases the procurement requirement.

FPR increased: The Forecast Pool Requirement increased from 0.917 to 0.926. This adjustment changes how much accredited capacity PJM needs to buy to meet the same reliability standard, and the direction of this change increased the requirement.

Together, these changes increased PJM’s overall reliability requirement and tightened the supply-demand balance, making a capped clearing price more likely.

Supply increased, but the market remained tight

Total supply offered into the auction increased compared with the prior year, and the total amount of capacity that cleared also rose modestly. Even with that increase, PJM did not procure enough capacity to fully meet its reliability target.

More than 800 MW of capacity did not clear because offer prices exceeded the cap, and the Installed Reserve Margin procured through the auction was well below the 20 percent target. This underscores how tight the market remains despite incremental supply additions.

Takeaway for PJM end users

Two consecutive auctions clearing at the price cap point to a structurally tight capacity market. The primary drivers are rising peak demand and higher reliability targets, not short-term market dynamics.

For end users of electricity in PJM, this means capacity costs are likely to remain elevated unless new reliable generation and other qualifying resources come online at a pace that keeps up with load growth. Understanding these drivers is increasingly important for budgeting, procurement strategy, and long-term energy planning.

For additional information please contact us to schedule a quick call.