Explore Other Resources

Subscribe Today!

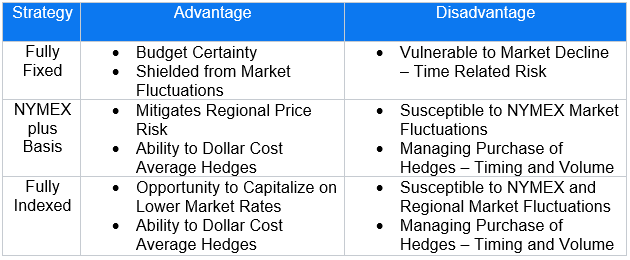

Natural Gas Purchasing Strategies

Buyers of natural gas have numerous purchasing options, but what makes the most sense for your business? Explore these common natural gas purchasing strategies to determine the most suitable option for you.

Fully Fixed: This represents the most secure choice, in which a purchaser secures a fixed rate for each unit of gas they consume throughout a specified contract period. This approach guarantees a consistent cost per unit for the entire duration of the contract. However, the drawback lies in the uncertainty surrounding the timing of the purchase.

Fully fixed contracts include premium charges that serve as an insurance policy for sellers combating any fluctuations in the market over the term. Buyers seeking budget certainty prefer a fully fixed contract to reduce market variability, especially to the upside. The downside to this strategy is that while the buyer has shielded themselves from the price risk, they have now assumed time risk. If the buyer purchases at a higher point in the market they run the risk of overpaying during the term, whereas a purchase near the lower end of the market spectrum would benefit the buyer over time, as the purchase occurred at an opportune time.

NYMEX Plus Basis: This strategy comprises two core elements: the New York Mercantile Exchange (NYMEX), which is based on Henry Hub, the central natural gas trading point situated in Erath, Louisiana, and the regional basis at the buyer's consumption location. Basis signifies the disparity in natural gas costs between NYMEX and the buyer's specific spot on the natural gas pipeline system. This disparity can fluctuate based on local supply and demand factors. In regions with ample supply, the basis may be discounted to the NYMEX, while regions with high demand tend to command a premium over the NYMEX.

Buyers adopting this strategy aim to mitigate the risk associated with regional pricing, an important consideration in certain areas. Simultaneously, they can keep the NYMEX price flexible, as it tends to exhibit lower volatility. This approach provides buyers with the flexibility to incorporate fixed purchases, either partially or in full, if market conditions or indicators signal a shift against them. It also allows them to remain responsive to the open market when conditions are favorable.

Fully Indexed: The least frequently utilized approach entails allowing both the NYMEX and the regional basis to fluctuate. This strategy is notably more intricate and necessitates vigilant tracking of shifts in the NYMEX rates, and, perhaps even more importantly, shifts in the basis, which can swiftly work against a buyer without affording much time to implement effective hedges. In areas with ample pipeline capacity and proximity to the NYMEX, the associated risks are reduced. Conversely, as a buyer's operations move farther away from the NYMEX, the risk of encountering substantial price volatility escalates.

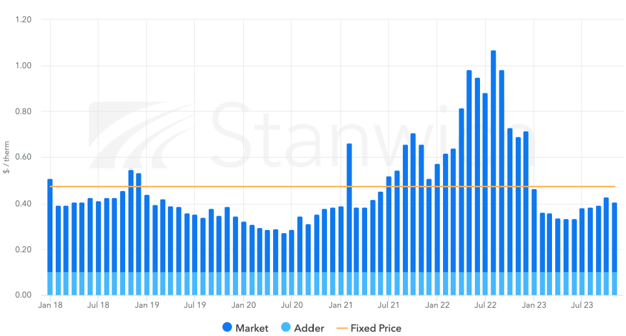

The chart below provides an illustrative view of market rate over time. The line represents a fully fixed rate and the bars indicate market rate. If the bars fall below the line, the buyer is paying more than the market, whereas, if the bars are above the line, the buyer is paying less than the market.

For further insights into the best strategy for your business, contact us to schedule a quick call.