Explore Other Resources

Subscribe Today!

Navigating Turbulent Waters: Impact of Red Sea Disruptions on Global Shipping and Energy Markets

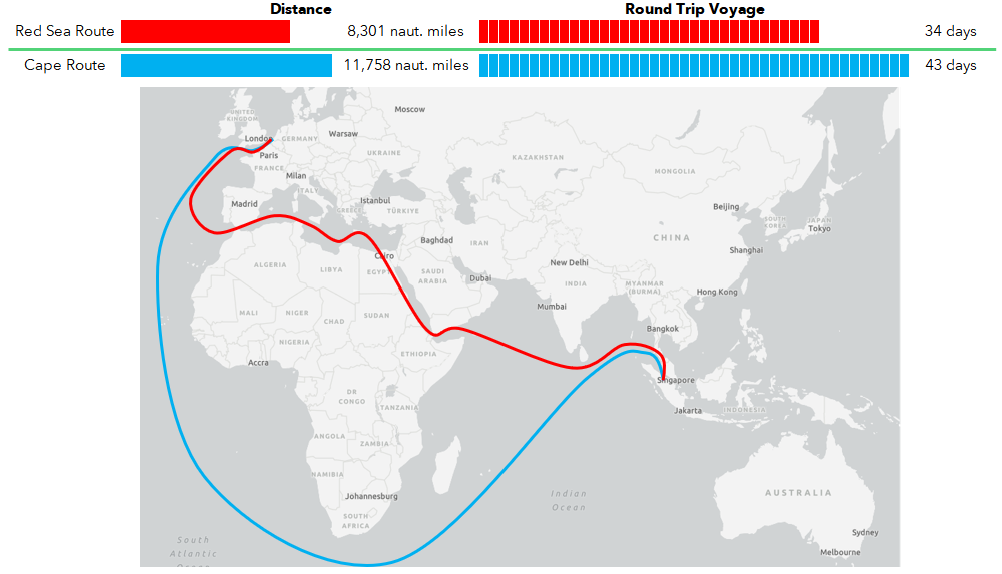

Recent attacks on ships in the Red Sea by Yemen’s Houthi group has prompted oil and Liquified Natural Gas (LNG) tankers to reassess routes. Some companies are opting for the longer but safer route around Africa, adding fuel costs and time. Others risk the Red Sea, facing increased insurance expenses. Though the impact on global energy markets is minor, continued risks could have more substantial effects.

- Attacks on ships in the Red Sea has led companies to reconsider routes, increasing shipping costs and causing delivery delays.

- LNG routes from the North Sea to Southeast Asia increase by 3,457 nautical miles, equating to 9 additional days round trip.

- High natural gas inventories in Europe and northern Asia is limiting LNG prices movement to the upside, oil prices have risen slightly since the attacks began.

The Red Sea, accessed by the Suez Canal to the north and the Bab-El-Mandeb, the straight to the south is responsible for roughly 12% of global oil and up to 8% of LNG activity. The recent attacks have pushed a significant number of companies to utilize alternative shipping lanes, most commonly around the horn of Africa, increasing costs and losing time in the process.

The Red Sea route sees significant participation from European importers and flows from Russia to Asia. Key players in LNG shipping include Qatar, the U.S., and Russia. While Asian spot LNG prices remain stabilized at ~$12.30 per MMBtu, sustained disruptions might exert upward pressure on prices later in 2024. The surplus of natural gas in Europe and North Asia is limiting price increases and will likely continue to do so through the winter. Most energy experts maintain confidence that major disruptions in supply and notable price hikes are improbable at this point, but there is potential for upside movement should these attacks continue to disrupt global oil and gas trade.

Contact us for more information.