Explore Other Resources

Subscribe Today!

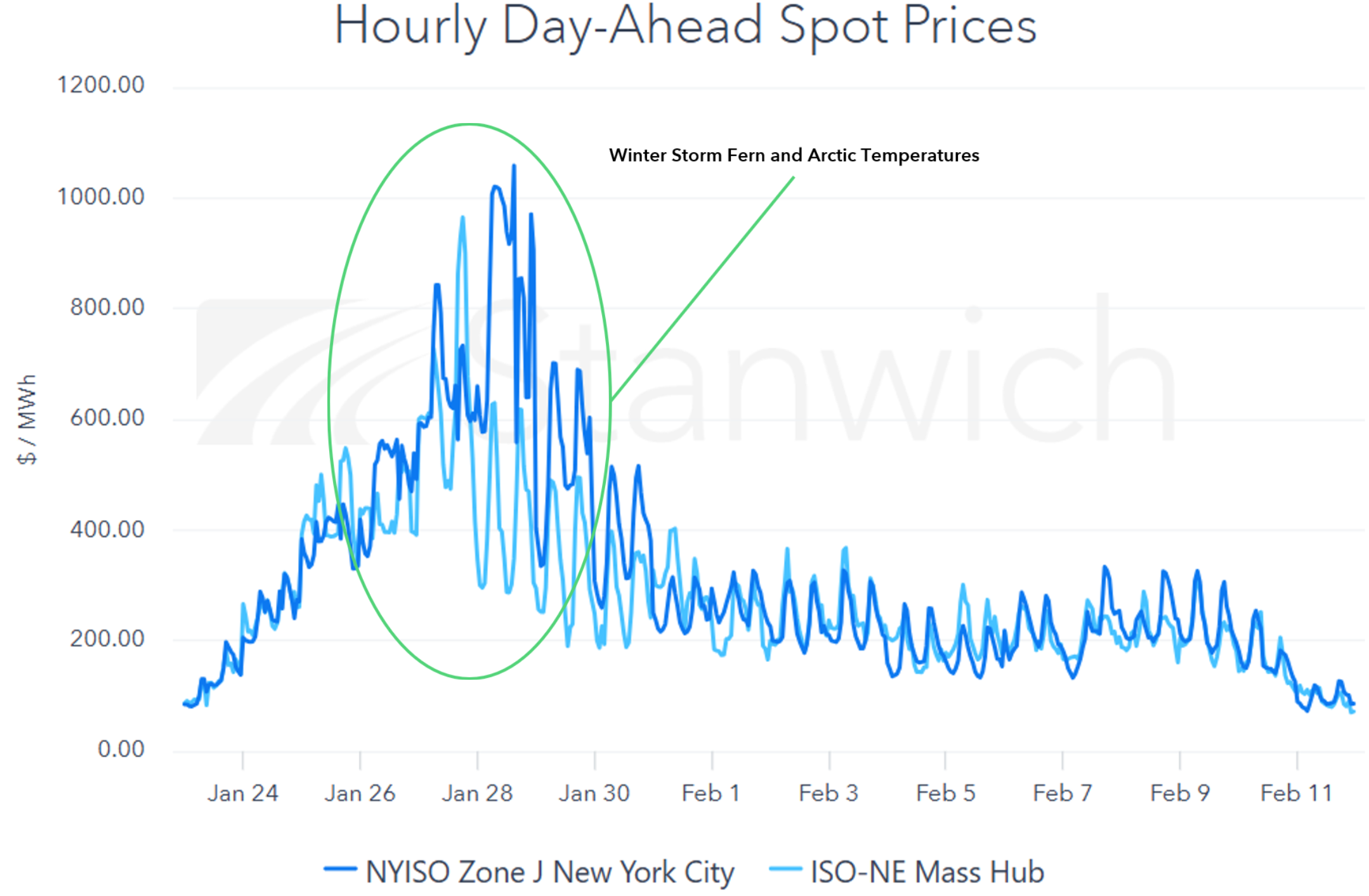

When Extreme Winter Tightens Canadian Exports to the Northeast

Winter Storm Fern was more than a cold-weather event. It was a real-world stress test of the Northeast power system, and a preview of how our increasingly interconnected grids behave when extreme weather tightens supply everywhere at once. As temperatures plunged across New England, New York, and Québec, electricity demand surged simultaneously in all three regions. Natural gas supplies tightened. Wholesale electricity prices climbed. And at the height of the storm, hydroelectric exports from Québec into New England were reduced as Hydro-Québec prioritized serving its own domestic load.

For consumers and policymakers, the moment raised a practical and timely question. If we are investing billions of dollars in transmission lines to import Canadian hydropower, what happens when we need that power most?

The HVDC buildout in the Northeast

Two major transmission projects anchor the region’s cross-border hydro strategy.

The New England Clean Energy Connect, or NECEC, is a 1,200 MW high-voltage direct current line that is now in service delivering hydro power into ISO-New England.

The Champlain Hudson Power Express, or CHPE, is a 1,250 MW high-voltage direct current line that will deliver power directly into New York City. CHPE is currently under construction and is expected to enter service in 2026.

Together, these projects represent up to 2,450 MW of potential imports into U.S. markets.

Both projects use high-voltage direct current, or HVDC, technology. In simple terms, an HVDC line is a long-distance electricity “express lane.” It allows large volumes of power to move efficiently from one region to another with lower losses and greater controllability than traditional alternating current lines. HVDC is particularly useful when connecting two separate grid systems, such as Québec and the U.S. Northeast.

Under normal operating conditions, these lines should provide meaningful benefits. Low-marginal-cost hydropower generally lowers wholesale clearing prices, reduces reliance on natural gas, and adds fuel diversity to systems that have historically leaned heavily on gas-fired generation. Over the course of a typical year, that added supply should:

- Put downward pressure on average energy prices

- Reduce exposure to gas supply volatility

- Lower emissions

- Improve overall resource diversity

In most hours, that is exactly how these imports are expected to function.

What Winter Storm Fern revealed

Winter extremes introduce a different dynamic.

Québec relies heavily on electric heating. When temperatures plunge, electricity demand rises rapidly. During Winter Storm Fern, Québec’s internal demand increased at the same time New England and New York were facing their own weather-driven load spikes. In those moments, the internal value of hydropower inside Québec rises significantly. Reliability becomes paramount.

Source: EIA

Even if transmission infrastructure is physically capable of moving power south, the supply behind that infrastructure may tighten. Transmission lines are highways for electricity. They move power, but they do not create it. If generation at the source must serve rising domestic demand, exports may decline.

This does not mean the projects fail. It means they operate within physical and economic constraints.

NECEC and CHPE are not identical

While both projects bring hydropower into U.S. markets, they operate under different structures.

NECEC primarily supports long-term supply contracts with Massachusetts and delivers power into the broader ISO-New England wholesale market. Its impact is spread across the New England system.

CHPE, by contrast, is tied to New York’s Tier 4 Clean Energy Standard program. Tier 4 is designed specifically to deliver clean energy directly into New York City, one of the most constrained and expensive load pockets in the country. Rather than being a traditional bundled energy contract, the CHPE arrangement centers on clean energy credits associated with power delivered into Zone J. That structure means the project is directly aligned with New York City reliability and decarbonization goals.

Both projects strengthen reliability and advance clean energy policy, but their market impacts will differ because of where and how the power is delivered.

How shortfalls get managed

When supply becomes tight, Hydro-Québec must balance several factors simultaneously:

- Domestic reliability obligations

- Contractual delivery commitments

- Financial consequences of non-delivery

- Replacement energy costs in export markets

Those tradeoffs determine how exports are managed during stressful events. In rare hours when demand is elevated everywhere at once, export volumes may be lower than nameplate capability.

For end users in New York and New England, the practical implication is straightforward. Most of the year, hydro imports should help lower costs and stabilize markets. During severe, region-wide cold snaps, price volatility can still occur if supply tightens at the source. The intended benefits of the lines are not erased, but they can be reduced in precisely the hours when markets are under the greatest strain.

The broader lesson from Winter Storm Fern is not that cross-border transmission is flawed. It is that interconnected systems share stress as well as strength. When multiple regions experience extreme cold simultaneously, every grid operator prioritizes keeping the lights on at home.

Hydropower imports are a powerful tool. They diversify supply, lower average costs, reduce emissions, and improve resilience in most conditions. But they are not guaranteed against every winter price spike.

Clear expectations are essential as the Northeast continues reshaping its energy system. Understanding both the strengths and the limits of these transmission investments will lead to better policy decisions, better market outcomes, and a more resilient grid over the long term.

For additional information please contact us to schedule a quick call.