Explore Other Resources

Subscribe Today!

Rising US Oil Production and the Impact on Associated Natural Gas

U.S. crude oil production has reached a historic peak of 13.2 million barrels per day during the third quarter of 2023, and this figure is expected to continue its upward trajectory into 2024. This surge in oil production is poised to have several significant impacts:

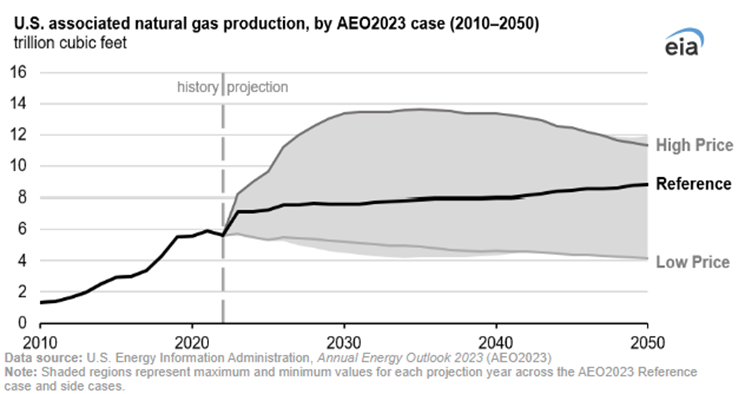

- Increased oil production will lead to a rise in associated natural gas production, a byproduct generated during the oil extraction process.

- The growth in associated natural gas production is anticipated to act as a restraining factor on future natural gas prices.

- The United States is projected to maintain its high levels of oil production to cater to the global market's demands and replenish its strategic reserve, which has been depleted by more than half over the past few years.

The United States currently leads the world in oil production, and this is expected to further expand in 2024. The driving forces behind this surge are higher oil prices and the necessity to replenish the strategic reserve. However, how can these higher oil prices and increased oil production contribute to lower electricity costs? The answer lies in the associated gas produced from oil extraction.

Associated gas is the natural gas that accompanies crude oil production and is typically separated from the oil at the wellhead. It contains a higher concentration of Natural Gas Plant Liquids (NGPLs), including ethane and propane, making it what is commonly referred to as "wet gas" as opposed to "dry gas" extracted from natural gas wells.

Despite a reduction in the number of oil rigs in regions like the Permian Basin and other Midwest oil fields, the increase in production has been achieved due to the efficiency of newer drilling technologies, which enable higher production while utilizing fewer resources. There is still a correlation between the number of active rigs and energy prices, but minor decreases in the oil rig count will not have as much of an impact as significant declines caused by plummeting oil prices. Typically, the breakeven price for oil drilling falls between $75 and $80 per barrel.

As US production continues to rise, so does the amount of associated gas. This will be crucial as the reliance on natural gas for various purposes, including power generation, industrial applications, residential and commercial needs, and supporting drilling activities, is expected to increase in the coming years. The growth in associated gas production will play a vital role in meeting the rising demand the country anticipates as it approaches the end of the decade.

To sum up, the continued increase in associated gas will sustain the ongoing growth in total natural gas production and is likely to moderate any upward price movements, at least in the near term.